Eye on U.S. GDP today

摘要:The U.S. equity markets saw a halt in their two-day rally, primarily pulled down by disappointing earnings from Meta Platforms. As a result, both the Nasdaq and S&P 500 were left nearly unchanged, while the Dow Jones Industrial Average closed lower. Market focus is now turning to Alphabet and Microsoft, whose earnings reports are due later today and are anticipated to influence market movements significantly.

Eye on U.S. GDP today

U.S. equity markets dragged by unsatisfied Meta Platform earnings performance.

The dollar fluctuated in a small range, awaiting today's GDP data.

Japanese Yen trade above the 155 psychological mark sparked intervention speculation.

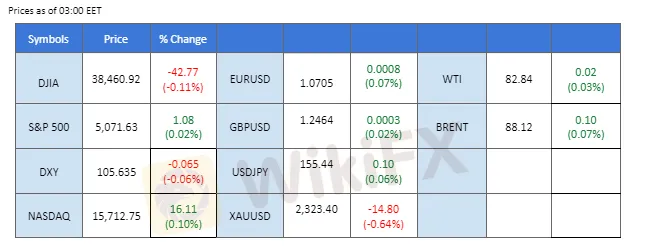

Market Summary

The U.S. equity markets saw a halt in their two-day rally, primarily pulled down by disappointing earnings from Meta Platforms. As a result, both the Nasdaq and S&P 500 were left nearly unchanged, while the Dow Jones Industrial Average closed lower. Market focus is now turning to Alphabet and Microsoft, whose earnings reports are due later today and are anticipated to influence market movements significantly.

On the currency front, the dollar experienced a slight recovery from just below the $106 mark. Investors are now keenly awaiting today's U.S. GDP data, which is expected to provide further insights into the dollar's trajectory. In Japan, the yen continues to struggle, breaking past the significant psychological resistance level of 155 against the dollar. Japanese officials have reiterated their readiness to take necessary measures to address the rapid depreciation of the yen, increasing the risk of potential market intervention.

In commodities, gold prices moved sideways, stabilising after a slight rebound in the previous session after the dollar gained in strength. Meanwhile, oil prices were buoyed by a notable decline in U.S. crude stockpiles, with WTI crude trading above the $83 mark.

Current rate hike bets on 1st May Fed interest rate decision:

Source: CME Fedwatch Tool

0 bps (97%) VS -25 bps (3%)

Market Overview

Economic Calendar

(MT4 System Time)

Source: MQL5

Market Movements

DOLLAR_INDX, H4

Despite upbeat Durable Goods Orders data, the Dollar Index only experienced bullish momentum slightly as investors awaited key economic indicators, including US GDP and Initial Jobless Claims reports. Anticipation surrounding these releases kept market participants on edge, with economists forecasting a potential decline in GDP from 3.4% to 2.5%. Continued monitoring of economic data performance is advised for traders seeking further trading signals.

The Dollar Index is trading flat while currently testing the support level. MACD has illustrated diminishing bearish momentum, while RSI is at 42, suggesting the index might have experienced technical correction since the RSI rebounded sharply from oversold territory.

Resistance level: 106.35, 107.05

Support level: 105.80, 105.25

XAU/USD, H1

Gold prices saw a slight retreat following better-than-expected Core Durable Goods Orders from the US, which bolstered dollar demand and dampened the appeal for dollar-denominated gold. Additionally, easing tensions in the Middle East contributed to a shift in investor sentiment towards riskier assets, including the US equity market. Attention remains focused on upcoming economic releases, such as US GDP, Initial Jobless Claims, and Core PCE Price Index, for potential market-moving insights.

Gold prices are trading lower following the prior retracement from the resistance level. MACD has illustrated increasing bearish momentum, while RSI is at 47, suggesting the commodity might extend its losses in short-term since the RSI stays below the midline.

Resistance level: 2330.00, 2360.00

Support level: 2300.00, 2270.00

GBP/USD,H4

The GBP/USD pair has settled within its previous price consolidation range, fluctuating between 1.2480 and 1.2430, following a technical rebound from its recent low. Sterling's resilience stemmed from upbeat PMI readings released earlier in the week. However, the pair is likely to be influenced by the upcoming U.S. GDP data scheduled for release later today.

The GBP/USD pair traded sideways in the past session, awaiting a catalyst to pick a direction. However, the RSI has rebounded and is close to the overbought zone, while the MACD has broken above the zero line, suggesting the pair is currently trading with bullish momentum.

Resistance level: 1.2540, 1.2660

Support level: 1.2370, 1.2260

EUR/USD,H4

The EUR/USD pair remained relatively subdued following its recent rally, trading within a narrow range. Against the backdrop of speculation regarding an early rate cut by the ECB due to the euro's CPI nearing its targeted inflation rate, market participants are closely monitoring today's U.S. GDP data to assess the pair's potential trajectory.

The pair is currently facing a strong resistance level at 1.0710. A break above this level suggests a solid bullish signal for the pair. The MACD is currently hovering above the zero line, while the RSI is on the brink of getting into the overbought zone, suggesting the bullish momentum remains strong.

Resistance level: 1.0775, 1.0866

Support level: 1.0630, 1.0560

USD/CHF,H4

The USD/CHF pair has been approaching its significant resistance level at 0.9145. The Swiss National Bank (SNB) was among the first major central banks to commence a rate-cutting cycle, a move that has weighed on the Swiss Franc. Concurrently, the better-than-expected performance of the U.S. economy has bolstered the dollar, contributing to the bullish momentum in the pair.

The USD/CHF is poised at its highest level since last October. A break above this level will be a solid bullish signal for the pair. The RSI has been gaining, while the MACD shows signs of rebounding from above the zero line, suggesting that the bullish momentum remains strong.

Resistance level: 0.9170, 0.9195

Support level: 0.9120, 0.9090

BTC/USD, H4

BTC prices experienced their first technical correction after nearing the $67,000 mark following the halving event. Nonetheless, positive developments persist in the crypto market, with the Hong Kong authority granting approval for the first batch of BTC ETFs. Furthermore, Standard Chartered's leading crypto analyst has projected a potential rise in BTC prices to $150,000 by the end of 2024.

BTC has recorded a correction after a short consolidation at near $67000 mark. The RSI has dropped drastically while the MACD is approaching the zero line from above suggesting the bullish momentum is drastically eased.

Resistance level: 67540.00, 70880.00

Support level: 61750.00, 57060.00

USD/JPY, H4

The Japanese yen slumped to its weakest levels against the US dollar since 1990, driven by a string of positive US economic data releases. The widening yield differential between Japan and the US, fueled by higher US Treasury yields, further pressured the yen. While Japanese authorities have indicated vigilance regarding currency movements and potential interventions, lack of concrete actions disappointed yen traders, who remain alert to any signs of intervention.

USD/JPY is trading higher following the prior breakout above the previous resistance level. However, MACD has illustrated diminishing bullish momentum, while RSI is at 80, suggesting the pair might enter overbought territory.

Resistance level: 158.45, 160.00

Support level: 154.70, 151.70

CL OIL, H4

Oil prices settled slightly lower amidst cooling tensions in the Middle East, reducing concerns of supply disruptions. Despite a significant decline in US crude inventories, exceeding market expectations, weaker gasoline demand weighed on oil prices. The Energy Information Administration's report revealed a sharp drop of 6.4 million barrels in US oil inventories, yet the reduction failed to offset the impact of decreased gasoline demand, highlighting ongoing market challenges.

Oil prices are trading lower following the prior retracement from the resistance level. MACD has illustrated diminishing bullish momentum, while RSI is at 48, suggesting the commodity might extend its losses since the RSI stays below the midline.

Resistance level: 83.40, 84.65

Support level: 80.45, 78.00

免责声明:

本文观点仅代表作者个人观点,不构成本平台的投资建议,本平台不对文章信息准确性、完整性和及时性作出任何保证,亦不对因使用或信赖文章信息引发的任何损失承担责任

相关阅读

今日聚焦 | 美联储加息预期升温助美元涨近20年新高!英国4月GDP经济意外萎缩面临空头卖压

今日(06月14日)亚市开盘美日货币上涨,其他货币普遍下跌;金价回落但原油上涨。

今日聚焦 | 欧美货币在美国通胀及欧央政策公布前走强!日内静待欧洲央行货币政策来袭

今日(06月09日)亚市开盘欧美货币上涨,其他货币普遍下跌;金价和原油皆呈上涨走势。

今日聚焦 | 乌俄谈判进展愈发黯淡再推美元避险资金流入!英国GDP数据表现艳丽助推英镑上涨

今日(04月01日)亚市开盘英美加货币上涨,其他货币普遍下跌;金价上涨但原油持跌。

今日聚焦 | 欧元区通胀数据受乌俄局势增强升息押注!美国就业及GDP经济数据好坏参半

今日(03月31日)亚市开盘英欧货币上涨,其他货币普遍下跌;金价回涨但原油持跌。

天眼交易商

热点资讯

美元/加元小幅走强至1.4000上方,加拿大消费者物价指数成为焦点

印度央行可能进行干预,美元/印度卢比走软

ASIC起诉澳洲国民银行未能及时处理金融困难申请

欧元区 HICP 通胀数据公布前,欧元/英镑持稳于 0.8350 附近

今日外汇:持续震荡走势,焦点转向英国央行听证会和二线数据发布

黄金和白银的买入信号

澳元/日元价格预测:测试9日EMA均线100.50,动能可能发生改变

英镑盘整,焦点转向英国央行听证会

今日汇市:焦点重回美国经济数据和美联储官员讲话

加元中断两连涨势头,略现下跌

汇率计算